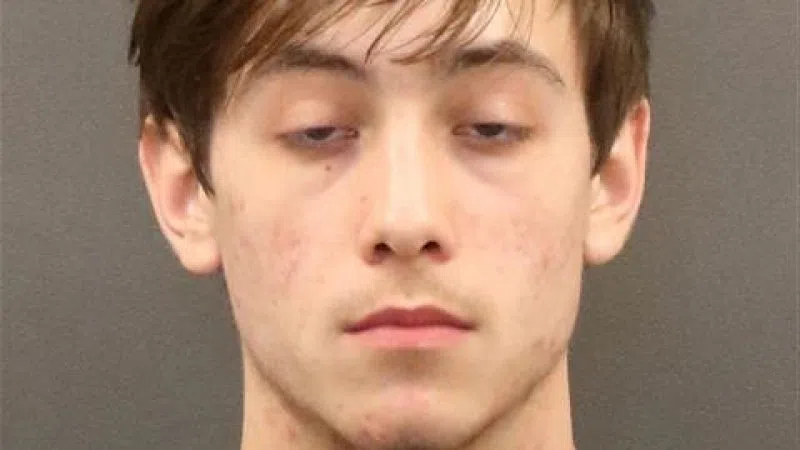

Gov. Jim Pillen, (Brian Neben, Central Nebraska)

KEARNEY — Governor Jim Pillen visited Kearney on Friday, Jan. 19 as part of his tour across Nebraska following his State of the State address. Pillen touted his plan for a 40 percent property tax cut.

“First and foremost, the most important economic issue we face is out of control property taxes,” Pillen said in his address to the Legislature, “High property taxes hurt every Nebraskan in every part of our state and must be fixed now.”

“With these changes Nebraskans’ property tax bill will be cut by 40 percent this year,” Pillen said in his speech.

During the event in Kearney, Pillen said Nebraska has the seventh highest property taxes in the country.

He said property taxes have grown rapidly in the last 15 years and can be traced in part to the 2007 Energy Independence and Security Act, signed by then President George W. Bush.

The act required fuel producers to use at least 36 billion gallons of biofuel by 2022.

Farmers worked to take advantage by making their agricultural land more productive and 24 ethanol plants were built across the state, Pillen said.

Also playing a role was the 2008 Great Recession, that Pillen said Nebraska weathered better than other states. He said the county was experiencing a deflationary period, but state government continued to grow, and politically popular tax cuts were made.

Pillen said all of this has led to a situation where, “transformative,” property tax reform is needed. He added that Nebraskans are, “being taxed out of their homes.”

One part of Pillen’s plan is a hard cap to control spending.

“Senator Linehan has introduced a hard cap on local spending, which can be overridden only by a vote of the people,” Pillen said in Lincoln, “This measure is critical, as only a hard cap will force local government to finally curb spending.”

Pillen also plans to shrink government and spend less and less each year from actual expenses.

In his opinion, Pillen said that state government’s responsibility rests in safety, education and infrastructure. He said the government should do more with less and being fiscally conservative during times of plenty will be better down the road during the lean times.

The idea is to get property taxes down from $5 billion to $3 billion, Pillen said.

He said this will require an “attitudinal adjustment,” on the part of state residents. One question Pillen has posed since he was on the campaign trail was the idea of what is more important, a resident’s local community or the state of Nebraska?

He said people will have to give a little in other places in order to help bring property taxes down to more manageable levels.

Pillen was adamant that there will be a 40 percent reduction, “no matter how long it takes.”

Gov. Pillen, (Brian Neben, Central Nebraska Today)

To have the tax funding shift, Pillen said he is open to all options but noted the only things off the table are initiatives that will make Nebraska less competitive when attracting businesses and taxing items that are found in grocery stores, which would hurt those on a fixed income or those in poverty, Pillen said.

Lobbying groups in the past rose in fury the last time a governor attempted to eliminate tax exemptions on some items that have been proposed, including business spending on accountants, advertising, legal advice, and pop and candy.

Pillen has also supported a $2-a-pack increase in cigarette taxes.

“Tax policy must benefit our state as a whole, not whoever has the best lobbyist,” Pillen said in Lincoln.

Some have criticized Pillen’s proposal.

The Tax Foundation said that “plans to propose legislation that would deliver property tax relief via a shift of some revenue collection away from local property taxes toward state-implemented taxes. While the proposal may succeed in reducing property tax bills, some of its broader implications would be undesirable.”

Open Sky Policy Institute noted, “As proposals emerge to meet the Governor’s goal of a 40 percent decrease in revenue generated from property taxes, let’s be clear that sales taxes are the most regressive tax category.”

To the dissenters, Pillen said “hogwash,” and reiterated that the property tax problem in Nebraska must be fixed now.