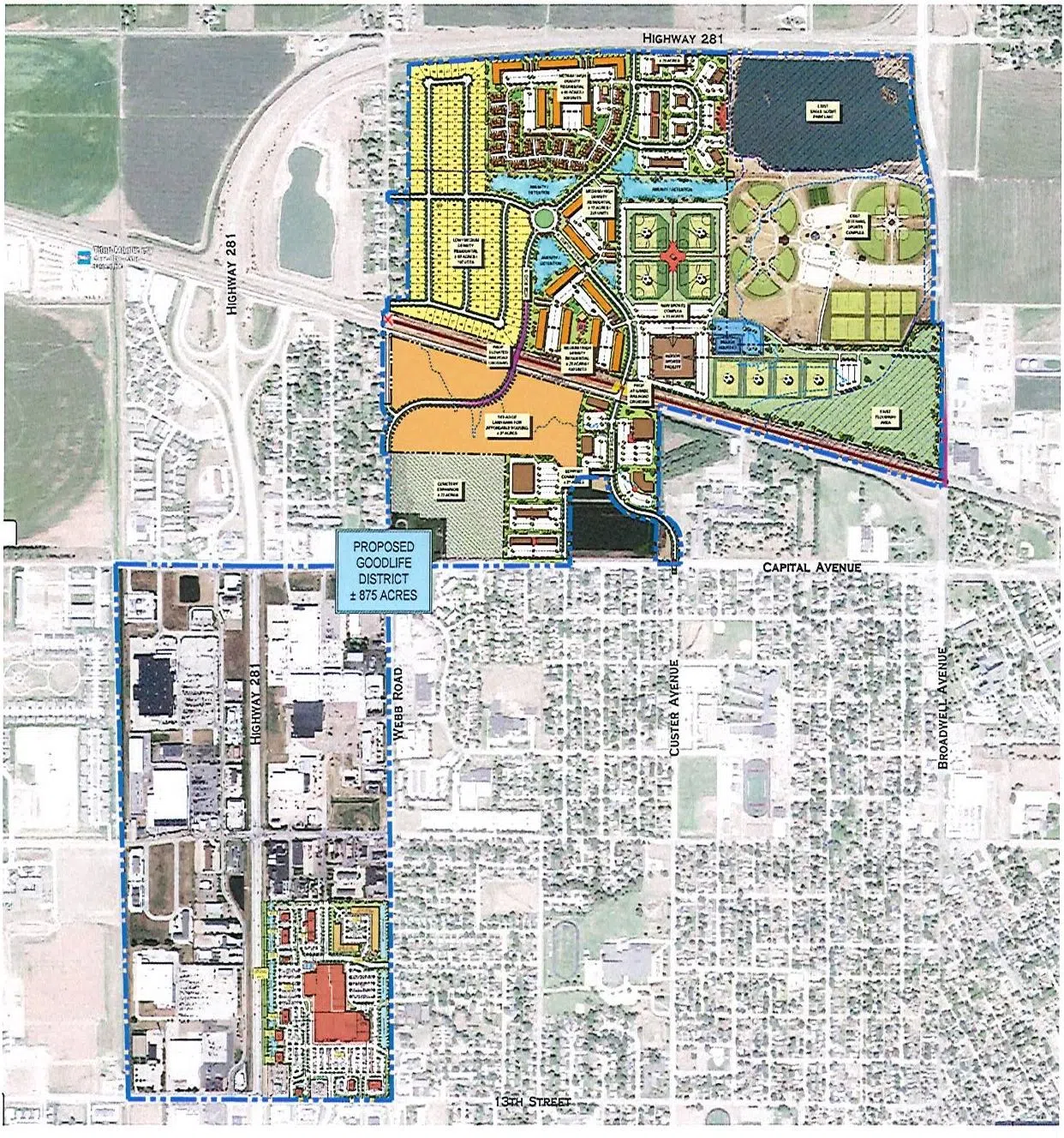

The proposed Good Life District, (Woodsonia Real Estate Inc., Courtesy)

GRAND ISLAND – The Grand Island City Council is having a special meeting at 7 p.m. Tuesday, June 18, to discuss having a special election on Aug. 13 regarding establishing a local Good Life District economic development program.

Woodsonia Real Estate submitted an application to the Nebraska Department of Economic Development for the project.

With the formation of the Good Life District, the Nebraska Department of Revenue will reduce the state sales tax rate within the entire Good Life District from 5.5 percent to 2.75 percent.

There are two regions for the Good Life District. The west district goes along Highway 281 from 13th Street to Capital Avenue. The northwest region is bounded by Capital Avenue, Broadwell Avenue, and Highway 281.

Last week, Kate Ellingson, marketing and public relations director for the Nebraska Department of Economic Development, said that Woodsonia is making an estimated $550 million investment in the project, and estimated that 5,000 new jobs would be created. She declined providing any other information regarding the contents of Woodsonia’s application.

According to a Dec. 19 memo from City Administrator Laura McAloon to the City Council, the development includes “indoor and outdoor sports and recreation facilities, market rate and affordable housing projects, public infrastructure improvements, and limited commercial corridors to support the developed area.”

In a June 18 memo to City Council, McAloon said that the Department of Economic Development formally approved Woodsonia’s application on June 5. The Department of Revenue notified the city that the state’s sales tax rate of 5.5 percent will be reduced on Oct. 1, 2024, to a rate of 2.75 percent within the area of the Good Life District.

In 2023, the Legislature decided to lower its sales tax rate in Good Life Districts to promote and develop the economy of the state and its communities. In 2024, the Legislature determined that cities were unable to assist the development of Good Life Districts under existing law, so the Legislature enacted the Good Life District Economic Development Act.

If creation of a Good Life District is approved by voters, the City Council could impose either or both of the following: Local option sales tax of 2.75 percent (to replace the sales tax given up by the state) or occupation taxes, similar to the occupation tax approved for the former Conestoga Mall.

The Department of Revenue has told the city that 2023 net taxable sales within the approved Grand Island Good Life District was $286,737,879. Based on that information, if the Good Life District existed in 2023, the city could have recaptured 2.75 percent or $7,885,292 from existing retail sales in the recently approved boundaries. A Good Life District exists for 30 years.

McAloon wrote, “The Administration recommends calling a special election to allow Grand Island citizens to vote on whether the City should be authorized to establish a Good Life District Economic Development Program within the approved Good Life District and allow the City to recapture the State’s foregone sales taxes and use that revenue here in Grand Island.”

The Good Life District does not include the former Nebraska Veterans Home property, which is owned by White Lotus Group of Omaha, or the Grand Island Veterans Club property.