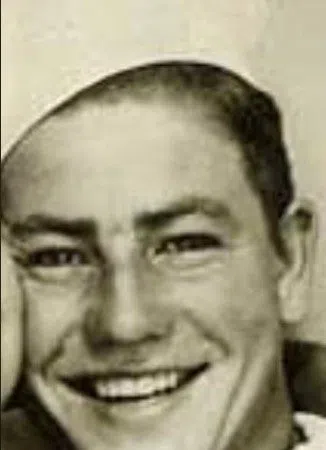

Gov. Jim Pillen, (Brian Neben, Central Nebraska Today)

LINCOLN — Ahead of this week’s special session aimed at addressing Nebraska’s escalating property tax crisis, Governor Jim Pillen is issuing a ‘statement of principles’ as to how he will approach the debate on reforming Nebraska’s imbalanced sales tax exemptions.

“This legislative process depends on everyone bringing their good faith ideas for the purpose of producing property tax reform for all Nebraskans,” said Gov. Pillen. “It is important that we start from a common place of understanding, especially in the debate over sales tax exemptions.”

Gov. Pillen’s statement of principles follows:

- No sales tax on food

- No sales tax on medicines used for human treatment

- No taxing services or goods provided through nonprofits

- No sales tax on ag inputs or manufacturing materials (defined as physical economic resources used to create goods to be sold to an end user)

- No sales tax on services or items that are exempt in all other states

- No sales tax on services or items that are exempt in all surrounding states

- No double taxation

“I think these principles will help provide clarity and structure to what we need to consider when it comes to that long list of exemptions that are in play,” said Gov. Pillen.