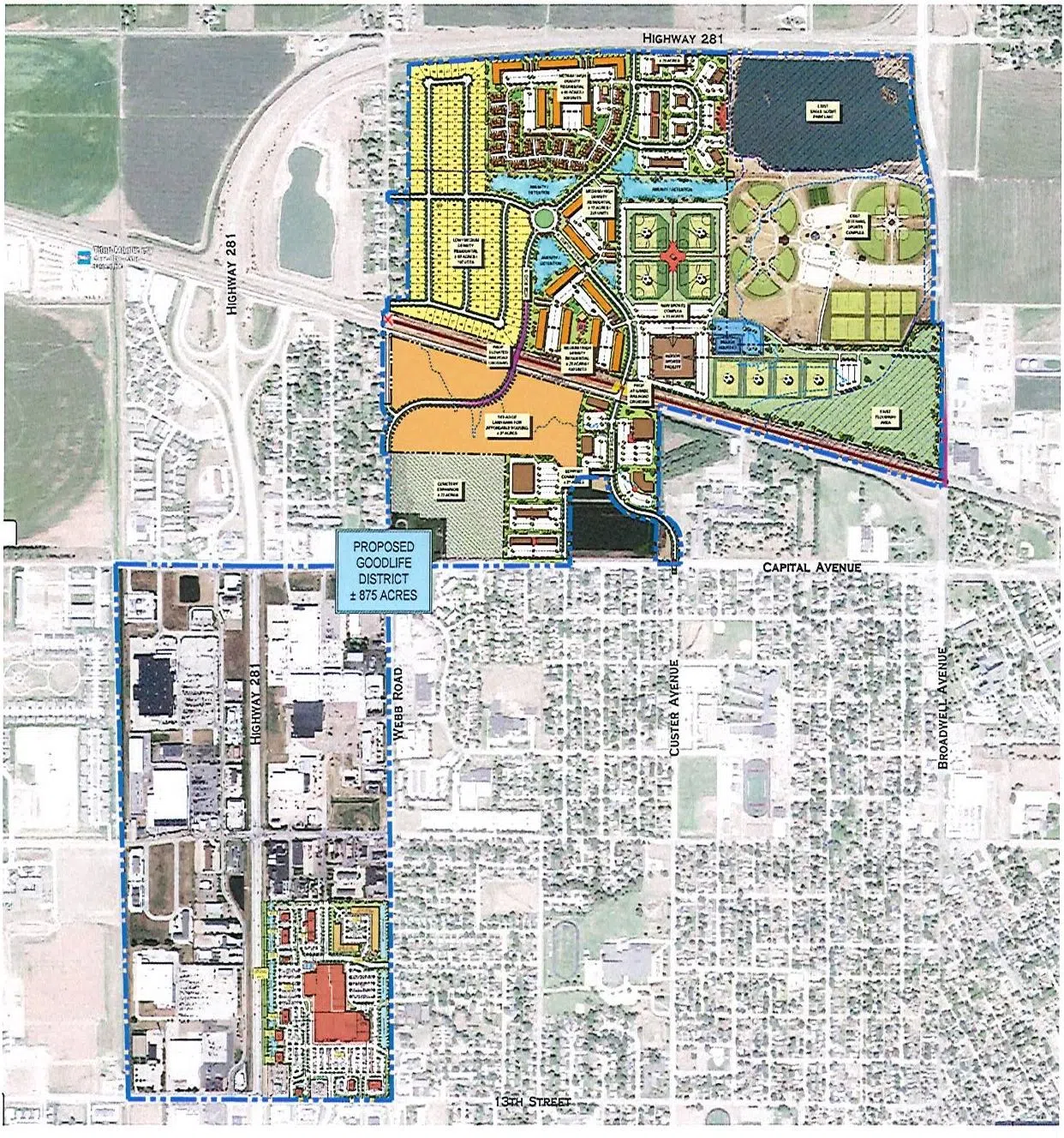

The proposed Good Life District, (Woodsonia Real Estate Inc., Courtesy)

GRAND ISLAND – The Grand Island City Council voted 10-0 Sept. 3 to approve a Good Life District Economic Development Program ordinance that will be added into city code.

City Council members had numerous questions about the 16-page ordinance concerning the Good Life District Economic Development Program.

City Attorney Kari Fisk noted that the ordinance had a lot of “legal language” in it.

Fisk said that Grand Island is the first community in the state to adopt a Good Life District Economic Development Program.

She said creation of the Good Life District does not represent any increases in taxes to the city of Grand Island. The ordinance creates a mechanism to follow for how money will come out of the fund.

A Good Life District application form will be developed by city administration. The City Council will make the final decision about whether to approve a Good Life District application.

She said that the ordinance can be modified by a two-thirds vote of the City Council.

Council member Doug Lanfear asked whether the city would handle the Good Life District funds, or whether Woodsonia real estate would handle the funds. Fisk responded that the city would handle the funds.

Council member Bethany Guzinski asked when someone could submit an application. The response was the next day, Sept. 4.

Guzinski wondered whether the Good Life District program would create an accounting burden on businesses in the district. Fisk responded that the city will minimize that as much as possible.

Council member Mitch Nickerson said that the City Council deserves recognition for having the Good Life District program forwarded for a public election. He noted that voters approved the Good Life District program by a 2-1 margin.

Nickerson said both the City Council and the public would have oversight of the Good Life District program applications.

Nickerson said that his main concern was the application fee schedule contained in the ordinance, particularly for larger requests. He noted that a program request of $5 million to $10 million had a $20,000 application fee. The application fee for a request for more than $10 million increased to $50,000. He was concerned about the jump from the $20,000 fee to the $50,000 fee. He felt that more incremental steps needed to be included in the fee schedule.

“That’s the only thing that sticks in my craw about this,” Nickerson said.

Council member Chuck Haase asked about changing boundaries of the Good Life district. Fisk responded that changes could be made with a two-thirds vote approval by the City Council. Fisk said that the application fee will not be refundable, because a lot of city departments would have spent time reviewing the application.

The other fee contained in the ordinance is that the city will charge a quarterly administrative fee to the Good Life District Program Fund equivalent to 3 percent of the local sources of revenue deposited with the fund in the quarter preceding any disbursement.

“This quarterly fee shall be used to cover the City’s internal administrative, financial, and legal expenses related to the administration of the program including the cost of publication of any requests for proposals, meeting notices, or public hearings, and the cost of routine financial management of the Program Fund by city personnel,” the ordinance said.

Fisk said that an application would first be reviewed by city personnel and would remain confidential at that time. Then, when the application is forwarded for review by the City Council, the application would become public. Fisk noted that the funds are designed for “once in a lifetime projects.”

Fisk said that time that city personnel spends working on Good Life District applications will be tracked.

Council member Jack Sheard said that the city needs to be strategic about how it documents time spent on the Good Life District program.

Chief Financial Officer Patrick Brown said that the Good Life District program is not expected to result in addition of any financial-related staff. He said there will be an online portal for the program.

After the meeting, Cindy Johnson, long-time former president of the Grand Island Chamber of Commerce, commented about approval of the ordinance.

“The state recognizes the potential in Grand Island for a transformational project,” she said.

She said that Grand Island has had to fight for a lot of funds from the state of Nebraska.

“This is a program that is available to us because they saw the potential,” she said.

From the ordinance:

“The Program recognizes the ability to use transformational development to improve the economic well-being of our citizens and our community through job creation, infrastructure, and other improvements that attract and retain tourists and college graduates from around the state.”

The ordinance continues, “The Program will focus on transformational and unique projects that generate new economic activity, expand the tax base and generate additional state and local taxes, create new economic opportunities, housing and jobs for residents, and promote retail, entertainment, and dining attractions.”

The program will remain in effect until June 5, 2054.

“The city may issue bonds…as it deems necessary from time to time. Such bonds may be issued in such principal amounts as the City Council determines are necessary to provide sufficient funds to carry out the Program or for any of the purposes of and powers granted pursuant to the Act.”

“From Oct. 1, 2024, to May 31, 2054, the city shall impose a Good Life District Occupation Tax in the amount of 2.75 percent on all establishments located within the Good Life District Program Area.”

People operating establishments within the program area shall make “A return on a form prescribed by the Finance Director, a return for the taxable calendar month preceding, and shall, at the same time, pay to the Finance Director the tax herein imposed.”

Applications for the program other than the City of Grand Island may occur by qualified response to any city-issued request for proposals seeking development proposals within the district or direct application for program funds made by a qualified business.

The application fees concerning amount of program funds requested are: under $500,000, $2,500; $500,000 to $1.5 million, $5,000; $1.5 million to $3 million, $7,500; $3 million to $5 million, $10,000; $5 million to $10 million, $20,000; and over $10 million, $50,000.

The City Administrator is responsible for developing and implementing the necessary documentation and schedule for initial application review. This process, and any required forms, will be made available on the city’s website.

“Application material shall be held in confidence…and shall not be considered public records until such time as a final application packet is prepared for Council consideration by the City Administrator.”

A preliminary review of the application will be made by a team that will include the City Administrator, the Finance Director, the Community Development Director, the Public Works Director, the City Attorney, and any other department heads the City Administrator deems necessary.

Qualified applications must be a qualified business, have minimal insurance coverage which names the City of Grand Island as an additional insured, and other factors.

The application proposal shall include a concise written summary of the project, the total cost of the proposed project, a summary of the financial structure proposed, documentation of commitments for financing of the project, and a summary of the request for program funds including the amount of funding, a proposed disbursement schedule, and whether the request is for payment of project expenses or reimbursement after project completion; a draft site plan; an estimate of the number of new permanent jobs created; and estimate of the number of temporary, seasonal, or construction-related jobs created; a list of all occupied structures to be built; developer governance documents; projected annual sales; projected annual out-of-state visitors to project; documentation of land acquisition; any purchase agreements; a summary of any annexations, rezoning actions, or blight studies; either an affidavit confirming that no tax increment financing will be requested or a summary or a summary of what tax increment financing is requested; what makes this project unique and transformational as opposed to normal or routine economic development and growth; what impacts will the project have on public services to include police, fire, schools, and public works; how will the project draw visitors from outside the state of Nebraska; and does the project fill an identified gap in available resources in Grand Island.

No project will be eligible if the project includes any portion of a public or private university.

Grand Island City Attorney Kari Fisk explains components of the Good Life District Economic Development Program ordinance to Grand Island City Council Sept. 3, (Carol Bryant, Central Nebraska Today)